48 is more favorable.

Nonbusiness energy property credit solar panels.

Tax credit for solar panels installed in residential property a valuable 30 credit for the cost of solar panels and related property is available for qualifying property installed in residential property used as a personal residence as well as for residential property held for rent.

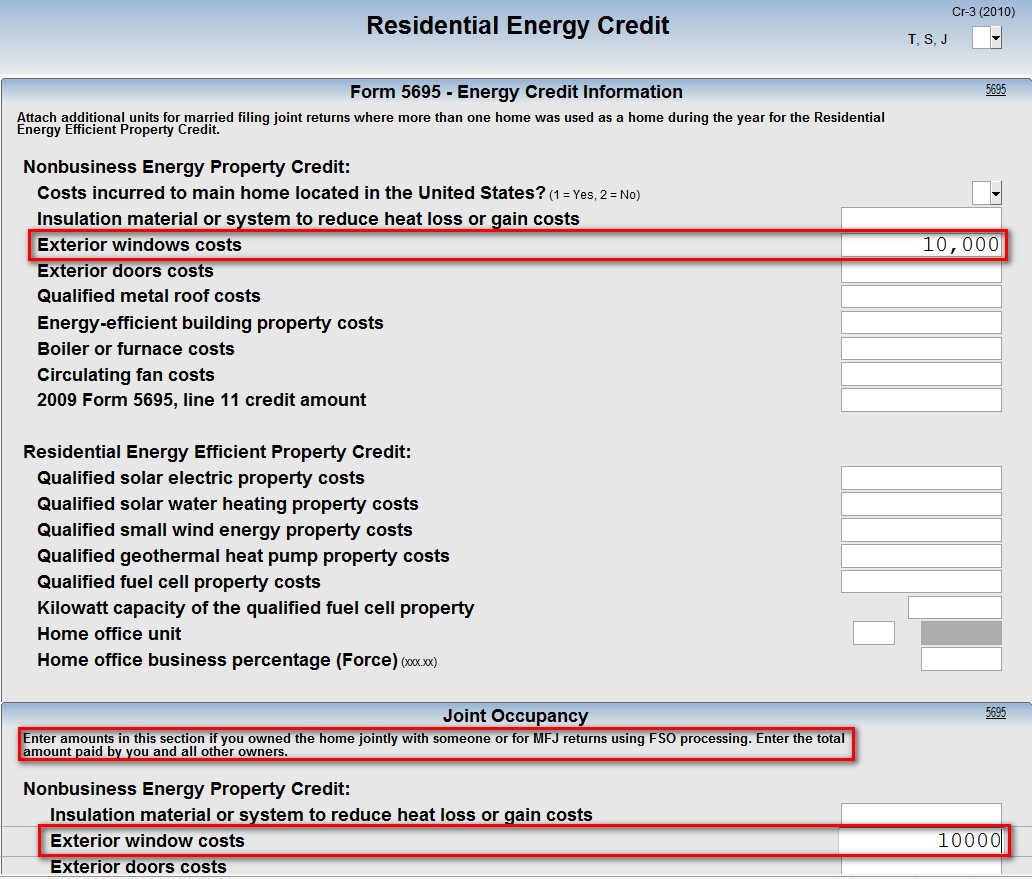

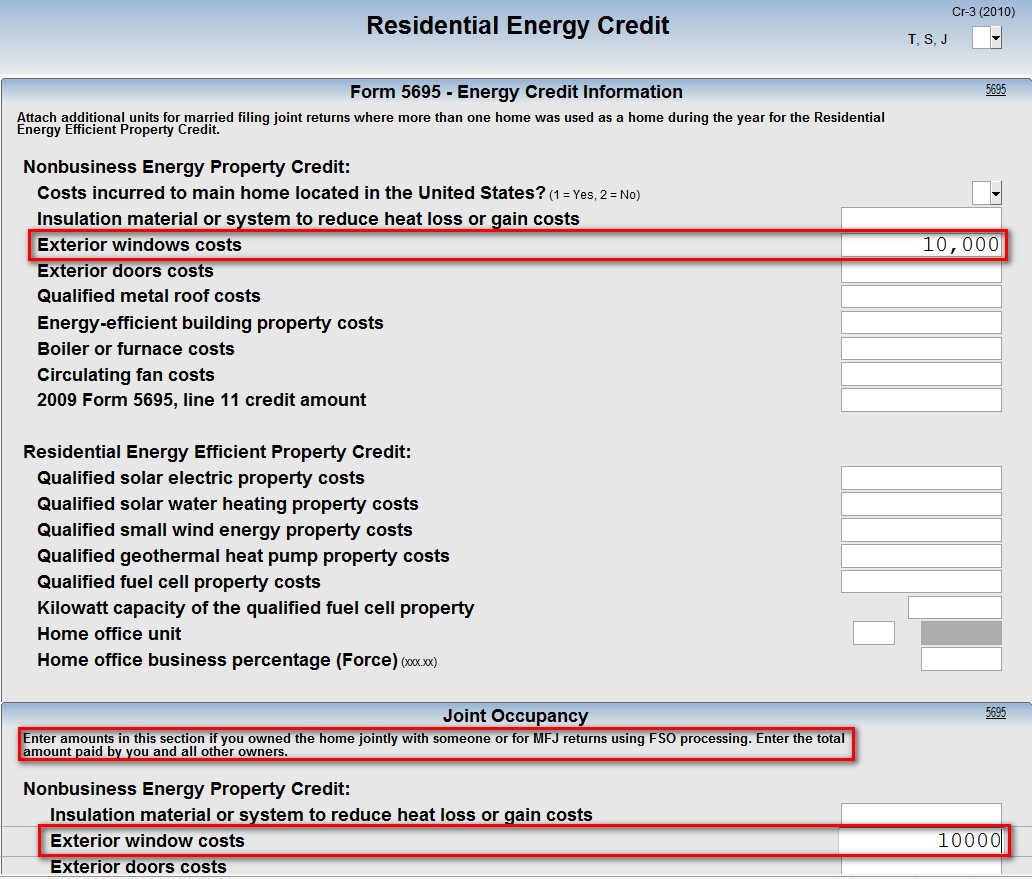

Nonbusiness energy property provided a credit for buying qualified energy efficiency improvements and provided credits in various amounts for costs relating to residential energy property expenses 26 u s c.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

There is no upper limit on the amount of the credit for solar wind and geothermal equipment.

Must be an existing home your principal residence.

Labor costs for onsite preparation assembly or original installation were included as eligible expenses for certain items.

For example a fuel cell with a 5 kw capacity would qualify for 5 x 1 000 5 000 tax credit.

The maximum tax credit for fuel cells is 500 for each half kilowatt of power capacity or 1 000 for each kilowatt.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

25d does not allow a solar tax credit for the cost of installing solar panels for use in residential rental property sec.

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property and fuel cell property.

48 provides for a solar energy tax credit for the installation of solar panels as part of the general business credit under sec.

The non business energy property tax credits have been retroactively extended from 12 31 2017 through 12 31 2020.

The itc applies to both residential and commercial systems and there is no cap on its value.